The Role of Emotion in Investing: How to Stay Objective

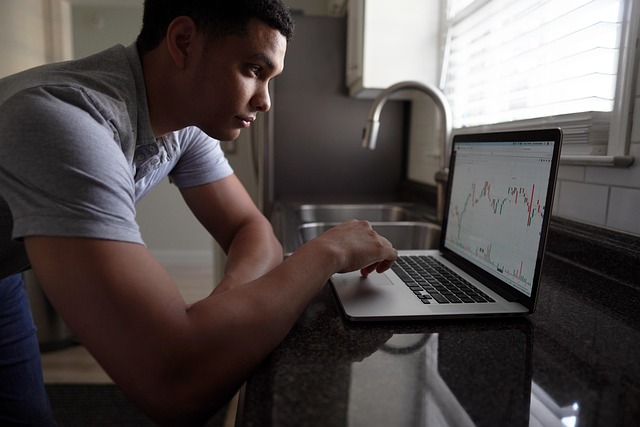

Investing can be a rewarding venture, but it often comes with its own set of challenges—chief among them being the emotional responses that can cloud judgment and lead to poor decision-making. Emotions like fear and greed are part of the human experience, influencing how we react to market movements and investment opportunities. Understanding the role emotions play in investing is crucial for anyone seeking to develop a sound investment strategy. In this article, we shall delve into the psychological dynamics of investing and outline strategies to maintain objectivity, ensuring your investment approach remains rational and well-informed.

The Emotional Landscape of Investing

Investing is not merely a financial exercise; it’s deeply intertwined with human emotions. Many investors experience a rollercoaster of feelings—excitement when a stock surges, anxiety during market downturns, and regret when realizing missed opportunities. These emotions can drive individual actions in ways that deviate from logical investment principles. To understand how emotions affect our investing decisions, it’s essential to explore some of the primary emotions that come into play.

Fear

Fear is one of the most significant emotions influencing investor behavior. It can manifest in various forms: fear of loss, fear of missing out, or even fear of market volatility. When markets become turbulent, many investors may panic, leading them to sell off assets at inopportune times, often resulting in realization of losses that could have been avoided with a cooler head. Fear of missing out on potential gains can also drive impulsive buying decisions, compounding the emotional strain.

Greed

On the other end of the emotional spectrum lies greed. It’s often quoted that greed drives investors to chase high returns without adequately evaluating the risks involved. This can lead to overconfidence, where investors take on more risk than they can bear, ultimately jeopardizing their financial future. Greed can obscure rational thinking and lead to decisions that deviate from an established investment plan.

Hope and Regret

Hope can be a double-edged sword. While it can motivate investors to hold onto struggling assets in the belief that their fortunes will change, it can also prevent them from making needed adjustments in their portfolio. Regret is another powerful emotion; many investors have found themselves regretting earlier decisions, which can lead to second-guessing and erratic behaviors in their investment strategies.

The Consequences of Emotional Investing

The influence of emotions in investing can have tangible consequences on the quality of decision-making and, consequently, investment performance. Emotional investing often results in a mismatch between actions taken and sound investment strategies. Below are some common pitfalls that stem from emotional reactions:

Investors may find themselves caught in the “herd mentality,” reacting to market trends and following what others are doing rather than adhering to their own analysis and strategies. This can lead to buying high and selling low, the classic investment blunder.

Another significant consequence of emotional investing is the high volatility of an investor’s portfolio. Frequent trading prompted by emotional responses can increase transaction costs, pushing down overall returns despite ostensibly well-intentioned efforts to optimize performance.

Moreover, an emotionally reactive approach can foster a lack of discipline. Without a rigorous strategy to guide decisions, investors may wander off course based on momentary fears or aspirations instead of a long-term vision.

Strategies to Stay Objective in Investing

Maintaining objectivity while investing is crucial for long-term success. Here are several strategies to help investors distance themselves from emotional decision-making:

Establish a Clear Investment Plan

One of the first steps in mitigating emotional influences is to lay out a clear and detailed investment plan. This plan should articulate your financial goals, risk tolerance, and time horizon. By having a defined strategy in place, you create a framework that allows for objective decision-making, ensuring your actions align with your long-term objectives rather than short-term emotional responses.

Conduct Thorough Research

Knowledge is a powerful antidote to fear and insecurity. By investing time in research and due diligence, you equip yourself with the necessary information to make informed decisions. Understanding the fundamentals of the assets you’re investing in greatly enhances your confidence in your choices, reducing the likelihood of emotional reaction-driven trading.

Use Data-Driven Decisions

Incorporating quantitative analysis into your investment strategy allows you to rely on data rather than emotions. Setting specific criteria for buying or selling assets—such as target prices, financial ratios, or performance metrics—can help keep your focus on objective indicators rather than subjective feelings.

Practice Mindfulness and Emotional Awareness

Recognizing your emotional state can be invaluable. Practicing mindfulness—taking the time to reflect on your feelings without immediate reaction—can help you distinguish between feelings that warrant a reaction and those that are merely momentary impulses. This awareness allows for more rational decision-making and less emotional reaction.

Limit Exposure to Market News

Information overload can heighten emotional responses. Constant news alerts, social media updates, and discussions with other investors can amplify anxiety or greed. Consider setting specific times to consume financial news, balancing it with a focus on your long-term investment strategy rather than getting caught up in short-term noise.

Use Automated Investing Tools

Consider employing automated investing tools, such as robo-advisors or algorithmic trading programs. These platforms follow predetermined algorithms that limit emotional influences. By allowing technology to manage portfolio adjustments based on set parameters, you can reduce the temptation to react impulsively to market fluctuations.

Adopt a Long-Term Perspective

Ultimately, keeping a long-term perspective can help mitigate emotional reactions. Understanding that market fluctuations are natural and that investing is a marathon rather than a sprint can cultivate patience. Frequent portfolio adjustments in response to market noise can compromise long-term success. Stick to your strategy and resist the urge to make hasty decisions based on short-term events.

Conclusion

Emotions play an undeniable role in the world of investing. While fear and greed can catalyze impulsive decisions with detrimental outcomes, recognizing these feelings and applying strategies to maintain objectivity can lead to more informed, rational investment choices. By establishing clear plans, equipping yourself with knowledge, and adopting discipline, you can reduce the emotional fog that often clouds judgment and work toward achieving your financial goals systematically. Remember, investing is about building a foundation for future growth, and doing so with a clear head will set you on the path to success.