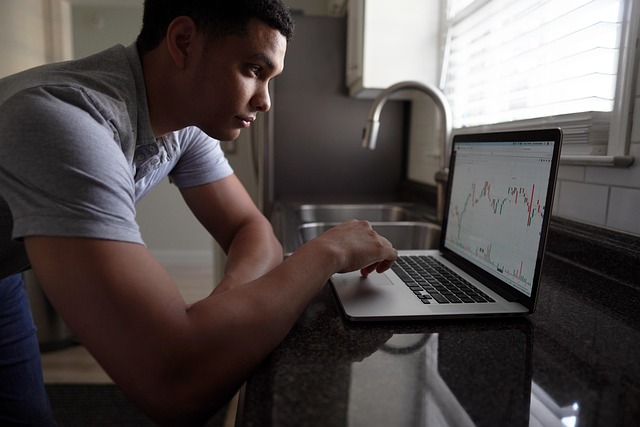

Understanding Risk: Balancing Potential and Reward in Investing

Investing is an essential component of building wealth, securing financial futures, and achieving personal financial goals. However, the potential for reward always comes with a degree of risk. Understanding this intricate relationship between risk and reward is critical for any investor, whether a novice or a seasoned professional. This article aims to elaborate on the concept of risk in investing, the various types of risks, how to assess them, and strategies to balance potential rewards with associated risks.

The Nature of Risk in Investing

At its core, risk refers to the uncertainty surrounding the future outcomes of an investment. Simply put, it is the possibility that the actual returns on an investment will differ from the expected returns. This variance can result in less favorable outcomes, including the loss of capital. In the world of investing, risk can often be seen as a double-edged sword. On one side, taking on risk can lead to substantial returns; on the other, it may result in significant losses.

Types of Investment Risks

Investors face various types of risks, each capable of impacting their investment portfolios in different ways. Understanding these risks is vital for making informed investment decisions.

Market Risk

Market risk, also known as systematic risk, is the risk of losses due to factors that affect the overall performance of the financial markets. Events such as economic downturns, political instability, natural disasters, and global crises can lead to widespread declines in asset prices. Since market risk cannot be mitigated through diversification, it is crucial for investors to recognize that even well-constructed portfolios can suffer during market shocks.

Credit Risk

Credit risk pertains to the possibility that a borrower will default on their obligations, such as bonds or loans. For investors in fixed-income securities, credit risk is paramount. Investing in lower-rated bonds (also known as junk bonds) may offer higher yields but encompass a greater risk of default. Therefore, assessing the creditworthiness of issuers is crucial for managing this risk effectively.

Liquidity Risk

Liquidity risk refers to the difficulty investors may face in buying or selling an asset without causing a significant impact on its price. Some investments, such as real estate or shares in smaller companies, can be illiquid, meaning they cannot be easily sold. Investors must be aware of liquidity risk, particularly in times of financial strain when selling assets quickly may result in unfavorable pricing.

Interest Rate Risk

Interest rate risk is the risk that changes in interest rates will negatively affect the value of an investment, particularly fixed-income securities like bonds. When interest rates rise, the value of existing bonds typically falls as newer bonds are issued at higher rates. This inversely proportional relationship means investors should consider interest rate trends when making bond investments.

Currency Risk

Investors engaged in international markets face currency risk, arising from fluctuations in exchange rates. For instance, if an investor holds shares in a foreign company, the return on investment can be affected by the movements in currency values. A strengthening domestic currency can reduce the overall return from foreign investments, and vice versa.

Regulatory Risk

Regulatory risk is the risk of financial loss due to changes in laws or regulations that govern investments. Changes in government policies, taxation, or regulations affecting certain industries can impact investment strategies substantially. Investors should stay informed about the regulatory landscape influencing their investments.

Assessing Risk in Investment Decisions

Determining an investment’s risk involves a combination of qualitative and quantitative analysis. Investors must assess various factors, including historical performance, market conditions, and potential future scenarios. While quantitative metrics such as standard deviation, beta, and value-at-risk (VaR) are widely used, qualitative assessments can provide additional insights.

Quantitative Measures of Risk

Quantitative risk assessments often involve statistical calculations to analyze the historical volatility and performance of an asset. Investors may consider:

- Standard Deviation: A measure of how much returns fluctuate from the average over a specified period. A higher standard deviation indicates a higher level of volatility and, consequently, increased risk.

- Beta: This indicates the sensitivity of an asset’s returns to market movements. A beta greater than one implies that the investment is more volatile than the market, while a beta less than one suggests less volatility.

- Value-at-Risk (VaR): A statistical measure that estimates the maximum potential loss on an investment over a given period, with a certain confidence level. VaR can help investors gauge potential downside risks.

Qualitative Factors

While quantitative metrics provide valuable insights, qualitative factors play an equally important role in assessing risk. These include considerations such as:

- Management Quality: The experience and competence of company management can significantly impact investment risks. A strong team might effectively navigate challenges, while weak leadership can increase risks.

- Industry Trends: Understanding the dynamics of the industry in which an investment operates is crucial. Factors such as competition, regulatory changes, and technological advancements can influence investment risk.

- Company Fundamentals: Analyzing financial health through revenue growth, profitability, and debt levels can provide insights into long-term viability and associated risks.

Balancing Potential and Reward in Investing

Finding the right balance between potential rewards and acceptable risks is the essence of prudent investing. Strategies to balance these two elements can vary depending on individual financial goals, risk tolerance, and time horizons.

Diversification

Diversification is one of the primary strategies investors utilize to mitigate risk. By allocating capital across various asset classes and sectors, investors can reduce the risk of significant losses if one investment underperforms. For instance, a diversified portfolio might include a mix of stocks, bonds, real estate, and commodities. While diversification does not eliminate risk entirely, it can help smooth out overall portfolio returns.

Asset Allocation

Asset allocation refers to the process of determining the optimal mix of assets in an investment portfolio based on individual risk tolerance and investment goals. A conservative investor may favor a higher percentage of bonds and cash equivalents, while a more aggressive investor might prefer a greater allocation to equities. Regularly reviewing and adjusting asset allocations in response to changing market conditions is vital for maintaining the intended risk profile.

Risk Tolerance Assessment

Understanding personal risk tolerance is crucial for effective risk management. Risk tolerance refers to an investor’s ability to withstand volatility and potential losses without emotional distress. Factors influencing risk tolerance may include age, financial situation, investment goals, and investment experience. Conducting a risk assessment can help guide investment choices and strategies aligned with an individual’s comfort level.

Setting Realistic Goals

Investors must set realistic and achievable investment goals. Understanding that higher potential returns typically come with increased risk can help guide expectation management. Establishing specific financial goals, such as retirement savings, property purchase, or funding education, allows investors to create strategies that align with their risk-reward preferences.

Continuous Education

The investment landscape is constantly evolving, influenced by economic trends, innovations, and market dynamics. Staying informed about best practices, market analysis, and financial education can empower investors to make informed decisions. Continuous learning helps assess risks effectively and enhances the ability to react astutely to changing conditions.

Conclusion

Understanding risk is fundamental to successful investing. The relationship between risk and reward is intrinsic to the investment process, requiring careful analysis and strategic planning. By comprehensively assessing various types of risks, employing effective risk management strategies, and maintaining realistic goals, investors can navigate the inherent uncertainties in investing while working toward their financial objectives. Through a balanced approach to potential rewards and risks, investors can aspire to create portfolios that align with their aspirations and comfort levels.